Open a Demat Account

HOW TO OPEN A DEMAT ACCOUNT

Opening a Demat account is quick, simple, and accessible. Most of the reputed stockbrokers like Dealmoney and banks provide the complete experience of opening a Demat account online, and the account opening process requires around 15 minutes.

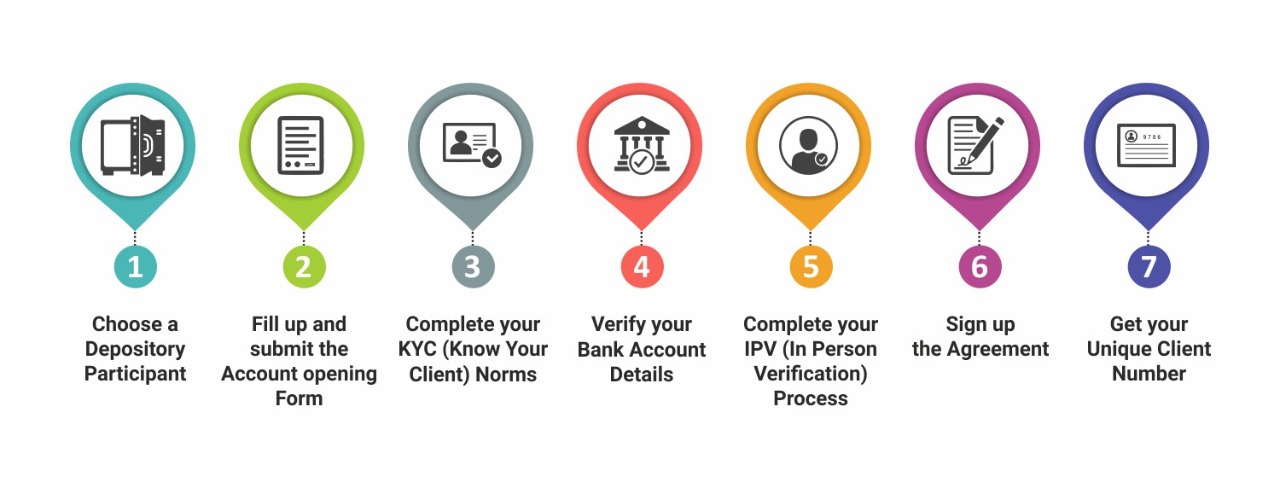

Here is a step by step guide for you

Step 1:- Choose a Depository Participant:

The initial step to open a Demat Account in India is to select a depository participant (DP). Most banks, Stockbrokers, and online investment platforms are DPs with either NSDL and CDSL, and all provide DP services. It is advisable to open a Demat account with a trading account or with the same broker you intend to trade with so that the transfer of shares to and from the stockbroker is seamless.

Step 2:- Fill up and submit the Account opening Form:

Go to your DP's website and fill in the online account form for opening the Demat account. However, various depository participants, such as Dealmoney, offer investors to open trading and Demat accounts simultaneously.

Step 3:- Complete your KYC (Know Your Client) Norms:

Once you've duly filled the Demat account opening form, DP will ask you to complete the Know Your Customer (KYC) norms. It will require you to submit scanned copies of KYC documents like your identity proof, address proof, and canceled cheque. Many brokers like Dealmoney give you the option to only submit your Aadhar number and canceled cheque instead of separate identity and address proofs. Therefore, it's good to keep all relevant documents ready before applying since this will help you get through the method faster.

Step 4:- Verify your Bank Account Details:

Dividends and other such benefits are transferred by the company directly to the bank account linked to your Demat account. Hence, you will need to enter your bank details by submitting or uploading a copy of your canceled cheque. You will need to fill in the details like your bank's MICR and IFSC code displayed on your cheque. Your bank account will be verified automatically by your DP and broker in case of a trading account.

Step 5:- Complete your IPV (In Person Verification) Process:

Your DP will ask you to complete an 'In-Person Verification procedure after submitting your Demat account opening form along with the required documents (IPV). It is a mandatory task to ensure that your documents are valid. Depending on your DP, you may be required to be present in person at one of your service provider's offices. Many depository participants like Dealmoney provide IPV services through a camera or a smartphone in a simple/easy manner

Step 6:- Sign up the Agreement:

Your DP will ask you to sign an agreement once you complete the IPV process. The agreement contains depository participants and investor's rights and duties. E-sign is done through NSDL instead of a physical signature in the online account opening form process, which is easy, convenient, and fast.

Step 7:- Get your Unique Client Number:

After completing this procedure, your DP shall proceed to process your Demat account opening form. Upon approval of your application, DP will provide you with a unique Identification Number. You can use this ID to access your Demat account. In the case of a trading account, you will receive a separate trading account code.

Choose a Depository Participant

Fill up and submit the Account opening Form

Complete your KYC (Know Your Client) Norms

Verify your Bank Account Details

Complete your IPV (In Person Verification) Process

Sign up the Agreement